Reverse Charge Mechanism under GST

- Background of Reverse Charge Mechanism

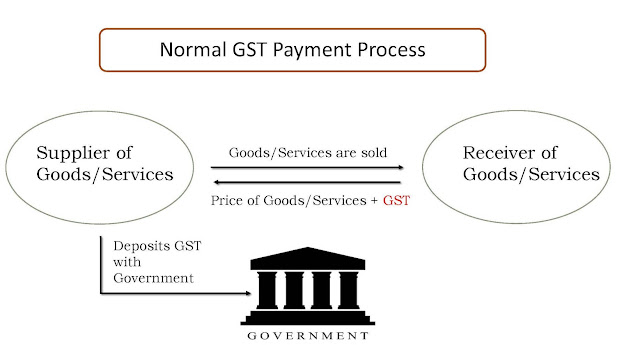

- Normal GST Payment Process

- Objective of Reverse Charge Mechanism

- GST Payment Procedure in case of Reverse

Charge

- Statutory Provision of Reverse Mechanism

- Reverse Charge on specified Goods

- Reverse Charge on specified Services

- Relevant Exemption related to services

covered under RCM

- Circular in respect of levy of GST on

director’s remuneration

- Additional Services on which tax is

payable by recipient under IGST Act, 2017 on Reverse charge basis under GST

- Supply of goods or services by an

unregistered supplier to registered recipient under RCM

- GST Registration under RCM

- Time of Supply under RCM in case of

goods

- Time of Supply under RCM in case of

services

- Invoicing Under RCM

- Accounts and Records

- Payment of GST under RCM

- Input Tax Credit under RCM

BACKGROUND OF REVERSE CHARGE MECHANISM

- Reverse Charge Mechanism was first introduced in Service Tax Law.

- Now, the Government has incorporated RCM in GST.

- Government has notified not only supply of certain services but also supply of certain goods under RCM.

OBJECTIVE OF REVERSE CHARGE MECHANISM

- Safeguard the interest of Revenue

- Administrative convenience of Government

Section 2(98) of the CGST Act, 2017

Section 9(3) of the CGST Act, 2017

The Government may, on the recommendations of the Council, by notification, specify categories of supply of goods or services or both, the tax on which shall be paid on reverse charge basis by the recipient of such goods or services or both and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both.

Section 5(3) of the IGST Act, 2017

The Government may, on the recommendations of the Council, by notification, specify categories of supply of goods or services or both, the tax on which shall be paid on reverse charge basis by the recipient of such goods or services or both and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both.

Comprehend two types of reverse charge scenarios in GST

Type A:

- Section 9(3) of the CGST/SGST/UTGST Act and Section 5(3) of the IGST Act

- On the nature of supply and/or nature of supplier

- Section 9(4) of the CGST/SGST/UTGST Act and Section 5(4) of the IGST Act

- On the nature of supply

- Supply received by a class of registered persons

- Supply made by unregistered supplier

Disclaimer: This is meant purely for general education purpose.While the information is believed to be accurate to the best of my knowledge, I do not make any representations or warranties, express or implied, as to the accuracy or completeness of this information. Reader should conduct and rely upon their own examination and analysis and are advised to seek their own professional advice. This note is not an offer, invitation, advice or solicitation of any kind. I accept no responsibility for any errors it may contain, whether caused by negligence or otherwise or for any loss, howsoever caused or sustained, by the person who relies upon it.

Thanks for visiting our blog and reading this article. Kindly provide your feedback on the above article in comment box below.

M: +91-99917-25373

No comments:

Post a Comment